Ripple and XRP: Ripple Xrp

Ripple and XRP are two distinct but interconnected entities in the world of blockchain technology and digital assets. Ripple is a company that provides a global payment network and a suite of solutions for financial institutions, while XRP is a digital asset that serves as a bridge currency within the Ripple network. Understanding their individual roles and the intricate relationship between them is crucial for comprehending their significance in the evolving landscape of finance.

History of Ripple and XRP

Ripple’s journey began in 2011 with the founding of a company called OpenCoin, which later became known as Ripple Labs. The company’s initial vision was to create a more efficient and cost-effective way for financial institutions to conduct cross-border payments. In 2012, Ripple Labs introduced XRP, a digital asset designed to facilitate transactions on its network.

XRP quickly gained traction as a bridge currency, allowing for faster and cheaper cross-border payments. The company also developed its RippleNet platform, a network of financial institutions that use Ripple’s technology to connect and settle payments. Over the years, Ripple has expanded its offerings, adding features like liquidity solutions and other financial services to its platform.

- 2011: OpenCoin, the precursor to Ripple Labs, was founded.

- 2012: XRP, the native digital asset of Ripple, was introduced.

- 2013: Ripple Labs launched RippleNet, its global payment network for financial institutions.

- 2014: Ripple Labs rebranded to Ripple and raised significant funding.

- 2017: XRP experienced a surge in value, reaching its all-time high.

- 2018: Ripple faced regulatory scrutiny and legal challenges.

- 2019: Ripple continued to expand its global reach and partnerships.

- 2020: Ripple launched its On-Demand Liquidity (ODL) service, further enhancing its cross-border payment capabilities.

- 2021: Ripple continued to innovate and navigate regulatory challenges.

Core Functionalities of Ripple’s Technology

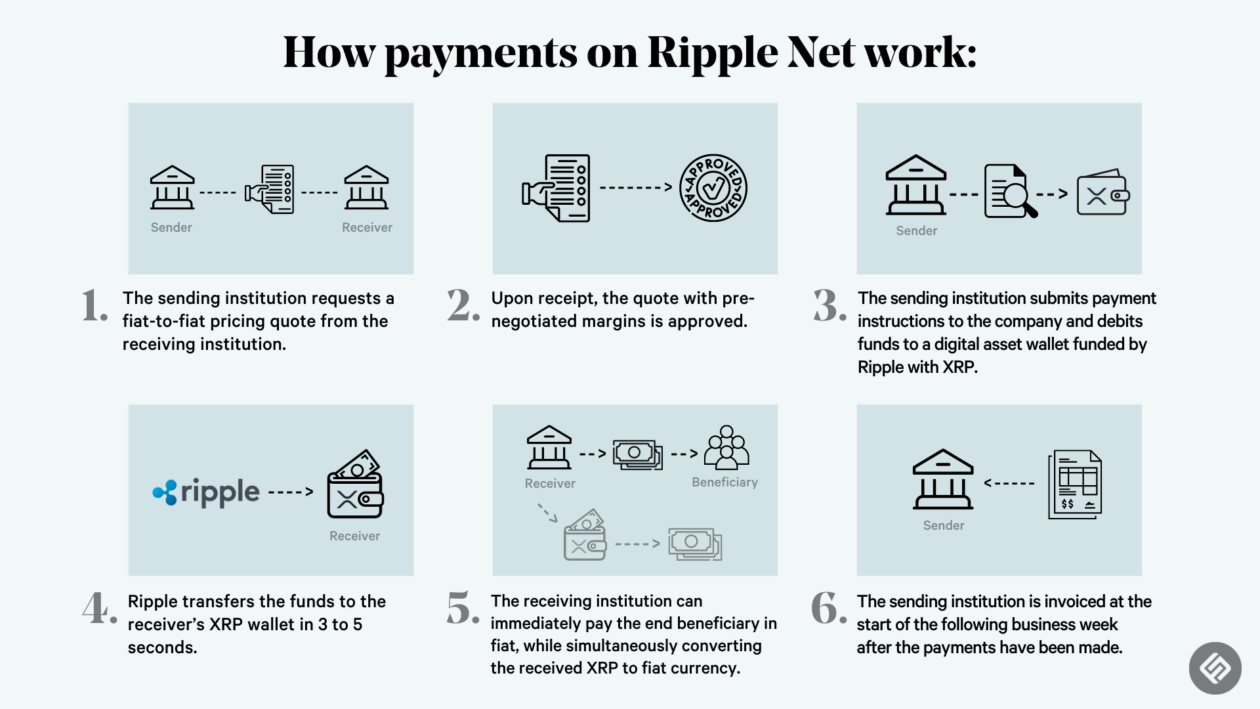

Ripple’s technology revolves around a distributed ledger system that enables fast, secure, and cost-effective cross-border payments. The core functionalities of Ripple’s technology include:

- Real-time settlement: Ripple’s network enables near-instantaneous settlement of transactions, eliminating delays associated with traditional banking systems.

- Low transaction fees: Compared to traditional payment systems, Ripple’s network charges significantly lower fees, making it a more cost-effective option for cross-border payments.

- Scalability: Ripple’s network can handle a high volume of transactions, making it suitable for large-scale financial institutions.

- Security: Ripple’s network employs advanced cryptographic techniques to ensure the security of transactions and protect against fraud.

Applications and Use Cases of XRP

XRP is a versatile digital asset with a wide range of applications beyond its role as a bridge currency within the Ripple network. Some of the key use cases of XRP include:

- Cross-border payments: XRP facilitates faster and cheaper cross-border payments by acting as a bridge currency between different currencies.

- Liquidity solutions: XRP can be used to provide liquidity for financial institutions, enabling them to manage their currency exposures and improve their operational efficiency.

- Micropayments: XRP’s low transaction fees make it suitable for micropayments, facilitating transactions involving small amounts of money.

- Digital asset trading: XRP is traded on various cryptocurrency exchanges, providing an avenue for investors to participate in the digital asset market.

The XRP Ecosystem

The XRP ecosystem is a complex network of interconnected entities that contribute to the functionality and growth of the XRP ledger. It encompasses a diverse range of players, including exchanges, financial institutions, payment processors, and technology providers. Understanding the relationships and interactions within this ecosystem is crucial for comprehending the dynamics of the XRP market and its potential for future development.

Key Players in the XRP Ecosystem

The XRP ecosystem is populated by a diverse group of actors, each playing a unique role in the network’s operation and evolution.

- Exchanges: Platforms like Binance, Coinbase, and Kraken facilitate the buying, selling, and trading of XRP. They provide liquidity and access to the XRP market for individual investors and institutions.

- Financial Institutions: Banks, payment providers, and other financial institutions are increasingly adopting XRP for cross-border payments and other financial services. They leverage XRP’s speed, low cost, and global reach to optimize their operations.

- Payment Processors: Companies like RippleNet, MoneyGram, and Flutterwave use XRP to streamline international payments, enabling faster and more cost-effective transactions for businesses and individuals.

- Technology Providers: Companies specializing in blockchain technology, such as Ripple, contribute to the development and advancement of the XRP ledger. They provide tools, infrastructure, and services that support the ecosystem’s growth.

Interactions and Relationships within the XRP Ecosystem

The various players within the XRP ecosystem interact in numerous ways, shaping the market’s dynamics and influencing XRP’s value.

- Exchanges and Financial Institutions: Exchanges provide liquidity for financial institutions to buy and sell XRP, enabling them to use it for cross-border payments and other financial services.

- Financial Institutions and Payment Processors: Financial institutions partner with payment processors to utilize XRP for international money transfers, reducing costs and improving efficiency.

- Payment Processors and Technology Providers: Payment processors rely on technology providers like Ripple to develop and maintain the infrastructure that powers their XRP-based payment solutions.

- Technology Providers and Exchanges: Technology providers often collaborate with exchanges to integrate XRP into their platforms, increasing accessibility and liquidity for the cryptocurrency.

Regulatory Landscape of XRP, Ripple xrp

The regulatory landscape surrounding XRP is evolving rapidly, with varying interpretations and regulations across different jurisdictions.

- SEC Lawsuit: In 2020, the US Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, alleging that XRP is a security. This case has significant implications for the future of XRP and its regulation in the US.

- Global Regulatory Developments: Many countries are developing their own regulations for cryptocurrencies, including XRP. These regulations vary in their approach, with some focusing on consumer protection, while others aim to promote innovation and growth in the industry.

- Potential Future Developments: The regulatory landscape surrounding XRP is expected to continue evolving, potentially leading to increased clarity and adoption of the cryptocurrency in various sectors.

Technical Analysis of XRP

XRP’s price history offers valuable insights into its market behavior and potential future trends. By analyzing past price movements, identifying significant trends, and applying technical indicators, traders can gain a better understanding of XRP’s volatility and potential price fluctuations.

Historical Price Performance

XRP’s price history reveals a volatile journey marked by significant rallies and corrections.

- Early Years (2012-2017): XRP’s initial years saw a gradual price increase, driven by its utility as a bridge currency for cross-border payments.

- 2017 Bull Run: The cryptocurrency market’s surge in 2017 propelled XRP’s price to an all-time high of over $3.80, driven by increased adoption and speculation.

- 2018-2019 Correction: Like many cryptocurrencies, XRP experienced a significant correction in 2018 and 2019, with its price falling below $0.30.

- 2020-2021 Recovery: XRP rebounded in 2020 and 2021, reaching prices above $1.00, fueled by renewed interest in Ripple’s technology and the growth of the DeFi ecosystem.

- 2021-Present: Since 2021, XRP’s price has been relatively volatile, influenced by regulatory uncertainties, market sentiment, and broader cryptocurrency market trends.

Technical Indicators

Technical indicators provide valuable insights into XRP’s market sentiment and potential future price movements. Some commonly used indicators include:

- Moving Averages (MA): MAs smooth out price fluctuations and help identify trends. A commonly used MA is the 200-day moving average, which can serve as a long-term support or resistance level.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 suggests XRP is overbought, while an RSI below 30 indicates it is oversold.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that identifies trend changes and potential reversals. Crossovers between the MACD line and signal line can signal buy or sell opportunities.

- Bollinger Bands: Bollinger Bands measure volatility and provide a range of potential price movements. Prices that touch or break through the bands can indicate potential price reversals or breakouts.

Factors Influencing XRP Volatility

XRP’s price is influenced by various factors, contributing to its volatility. These include:

- Regulatory Landscape: Regulatory actions and pronouncements concerning XRP and Ripple have a significant impact on market sentiment and price movements.

- Adoption and Partnerships: Increased adoption of XRP by financial institutions and partnerships with businesses can drive price appreciation.

- Market Sentiment: Overall market sentiment towards cryptocurrencies, as well as specific news and events related to XRP, can influence its price.

- Correlation with Other Cryptocurrencies: XRP’s price tends to correlate with the broader cryptocurrency market, often moving in tandem with Bitcoin and Ethereum.

- Correlation with Traditional Assets: XRP’s price can also be influenced by broader economic factors and trends in traditional financial markets, such as interest rates and inflation.

Ripple XRP, with its focus on global financial accessibility, is a fascinating technology. Just like how Kenny Pickett hopes to lead the Eagles to Super Bowl glory, XRP seeks to revolutionize how we move money across borders. The potential impact of Ripple XRP on the financial landscape is immense, and its success will be closely watched by those who believe in a more connected and transparent global financial system.

Ripple XRP, with its potential to revolutionize global payments, shares a similar spirit of innovation with Gwen Walz , Minnesota’s First Lady, who champions education and community development. Just as XRP seeks to bridge financial barriers, Walz’s initiatives aim to connect people and foster a brighter future for all.

The drive for progress, whether in finance or social welfare, underscores the power of forward-thinking ideas.